It is important to remember during periods of heightened volatility that investors stay within their targeted asset allocation ranges.

Over recent weeks, as the COVID-19 outbreak has expanded globally, Morgan Stanley’s Wealth Management Research team has been progressively reducing risk in our model portfolios. With our latest asset allocation update, we have effectively moved to maximum defence.

Importantly, although we have moved to a more defensive stance, all portfolios remain within their strategic asset allocation ranges. It is crucial during periods of heightened volatility that investors stay within their target asset allocation ranges.

With our model portfolios at their most defensive settings, we are now waiting for an appropriate time to increase our allocation back to growth assets. Our timing will be primarily driven by six key factors:

- Market multiples

- Profit expectations

- The Equity Risk Premium (ERP) for the S&P500

- The collective fiscal and monetary policy from governments and central banks

- Commodity prices

- COVID-19 new cases outside of China

Market multiples and profit expectations

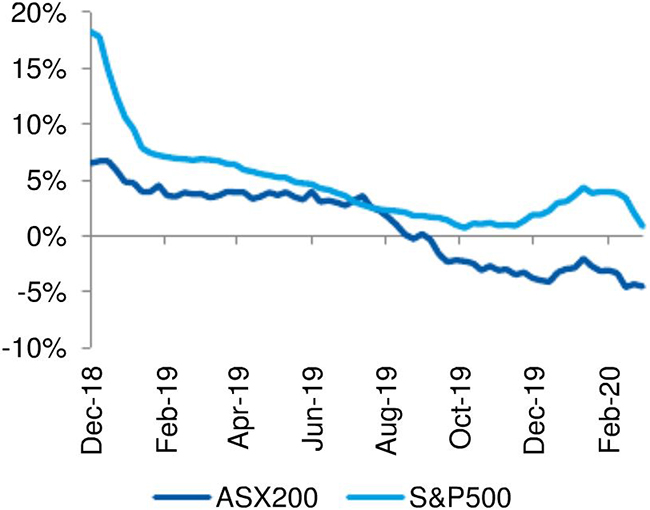

Our focus is on the ASX200 and S&P500. We are watching what market consensus is expecting in terms of future profit growth and what they are willing to pay for those future profits.

The chart below shows the decline in corporate profit growth expectations, which Morgan Stanley’s strategist teams have flagged for some time now. Despite the clear sign that corporate profits were slowing, until recently the sharemarket seemed impervious and continued to reach new highs.

YoY % Change in 12-Month Forward Profit Expectations

Source: Bloomberg, Morgan Stanley Wealth Management Research. As at 19 March 2020

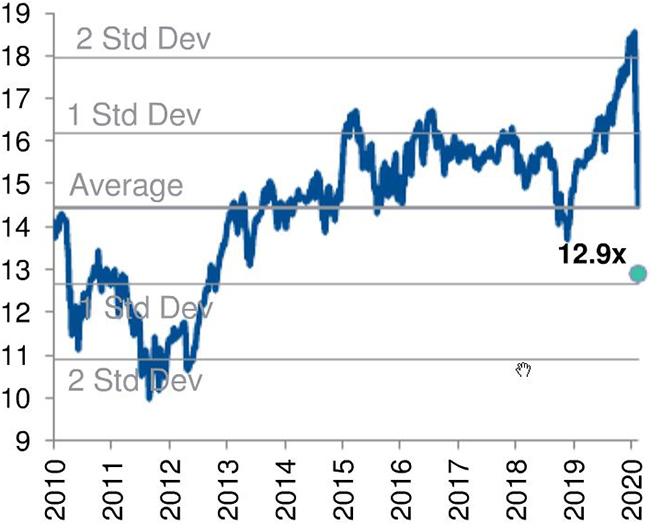

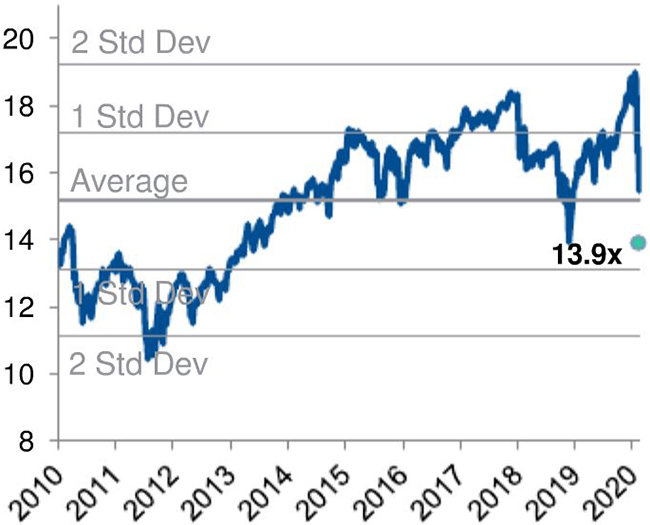

The two charts below show how extreme market multiples were before the recent COVID-19 related sell-off. The 12-Month Forward P/E multiple for the S&P500 was nearly two standard deviations above its average and the ASX2000 actually exceeded two standard deviations.

S&P500 Index, 12-Month Forward PE Ratio

Source: Bloomberg, Morgan Stanley Wealth Management Research. Standard Deviation (Std Dev). Green dot as at 19 March 2020

YoY % Change in 12-Month Forward Profit Expectations

Source: Bloomberg, Morgan Stanley Wealth Management Research. Standard Deviation (Std Dev). Green dot as at 19 March 2020

Slowing profit growth is usually associated with lower multiples in the market; this has finally happened with both the ASX200 and S&P500 multiples now below their respective long term averages.

The ERP

The ERP measures the compensation equity investors receive for taking the extra risk associated with owning shares over owning less risky government bonds. High

ERPs are typically associated with periods of high market volatility. The ERP on the S&P500 is currently around 6%. Not the highest reading in the past ten years, but certainly elevated.

Monetary and Fiscal policy

As recently noted by Chetan Ahya, Morgan Stanley’s Global Chief Economist, the weighted average policy rate amongst central banks around the world has declined 0.59% since December 2019 and is now below where average rates were during the Global Financial Crisis (GFC).

With regards to fiscal policy, Morgan Stanley estimates that announced fiscal stimulus measures in response to the COVID-19 outbreak from the G4 (US, UK, EU and Japan) + China are equivalent to 2.8% of global GDP. This will take fiscal spending as a percentage of those economies to levels higher than during the GFC.

The unprecedented steps taken with monetary policy to date seek to ensure the normal functioning of financial markets. This is one of the crucial lessons learned from the GFC - central banks need to act early to maintain the integrity of the financial system. The fiscal stimulus announced so far is impressive.

Commodity Prices

The demand for physical assets is a good proxy for economic activity. We focus on the commodity prices for iron ore, copper and oil. Prices here will provide additional insight into the health of supply chains and end demand.

COVID-19 New Cases

With the apparent peak of new COVID-19 cases in China now behind them, the focus is currently on containment efforts in the rest of the world. At this time, new cases outside of China continue to increase.

Modelling by Morgan Stanley suggests it will be some weeks before we see a peak in new cases in the US, Italy, Japan, South Korea, France, Germany and Spain.

Bottom Line

The evolution in valuations, profit expectations and policy increasingly will lay the foundation for a financial and economic recovery post the COVID-19 outbreak. However, the key driver will be a resumption in normal economic activity. The best indicator of this, in our opinion, remains the daily change in new COVID19 cases. Using China's example, people started to return to work after new cases peaked and social distancing measures were relaxed. This is a crucial inflection point, in our opinion. Naturally, the longer this takes, the further back is the starting point for all affected economies.

With regards to portfolio positioning, a well-diversified portfolio remains the best strategy. Our model portfolios have built up their defensive position and are in a strong place to either help meet day-to-day cash flow needs or be deployed in Growth assets when the conditions are right.

Having taken our portfolios to the edge, we patiently await more data to inform our next steps.

For more on Morgan Stanley’s asset allocation recommendations, see our latest Asset Allocation Insights or speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.