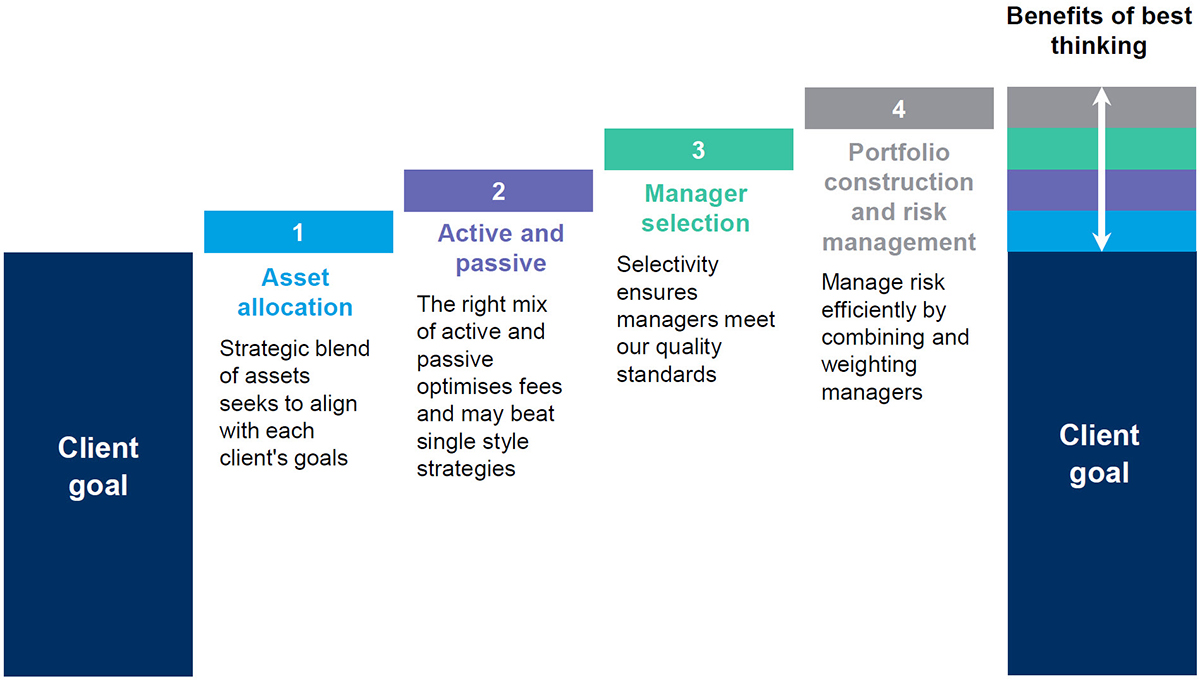

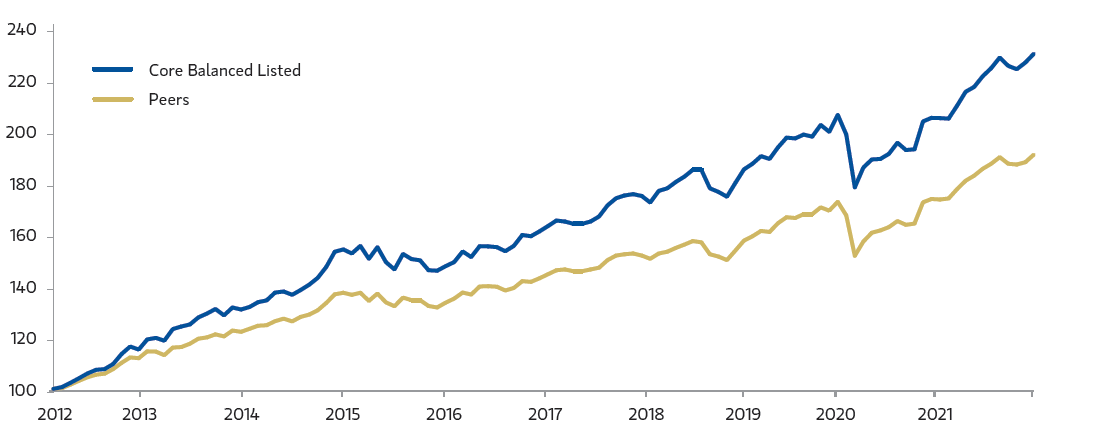

Multi-Asset Portfolio Solutions (MAPS) offers diversified investment portfolios that leverage Morgan Stanley’s award-winning research.

As of Friday, 21 June 2024 the Morgan Stanley MAPS Core Conservative Model, Morgan Stanley MAPS Core Balanced Model and the Morgan Stanley MAPS Core Growth Model (Models) will be exclusively available to Morgan Stanley clients.