As environmental, social and governance (ESG) factors become more broadly incorporated into investment decision-making, sovereign fixed income investors are grappling with the best way to benchmark and quantify these factors across a diverse group of countries.

While some use a simple approach of investing in countries with the highest third-party ESG ratings, our view is that there are better ways. We believe this ‘paint-by-numbers’ approach is systematically biased against developing countries, where the potential for ESG improvement is arguably greater. And by favouring wealthier nations, this approach is likely to result in a pool of low yielding assets that are highly correlated and from geographically concentrated countries.

Morgan Stanley Investment Management (MSIM) has developed what we consider to be a better approach.

A better framework

MSIM has developed a framework for benchmarking sovereign ESG performance that allows investment teams to quantify and compare ESG factors across the entire array of emerging and developed markets—from Papua New Guinea to Portugal.

By adjusting for income-per-capita, and adding an analyst-driven momentum factor, our approach seeks to reward positive changes from the countries with the greatest opportunity for ESG improvements. The result presents genuine opportunities for yield and diversification in portfolios in a manner consistent with ESG and sustainability goals. This broad approach is a powerful component in our toolkit for integrating ESG factors into sovereign investing.

Why unadjusted third-party ESG ratings miss the mark

A sovereign ESG benchmarking strategy that relies on unadjusted ESG scores is systematically biased against developing countries. We believe this is likely to be counterproductive given the potential for ESG improvements in developing countries is arguably greater.

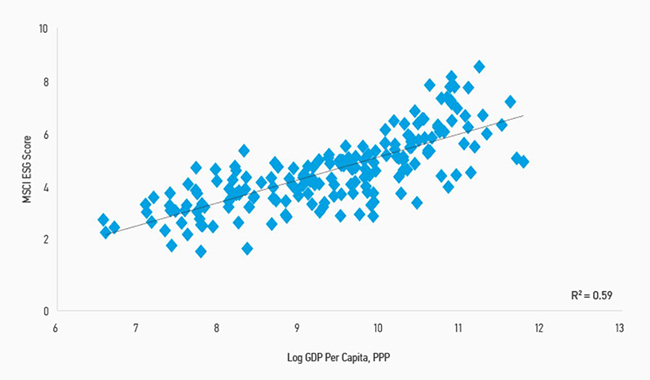

As shown in Display 1, a country’s level of wealth has explained nearly 60% of the variation in MSCI’s aggregate ESG scores.[1] The direction of causality between wealth and ESG scores likely runs in both directions. Improvements in ESG factors may contribute to a better growth environment, causing wealth to increase. In the other direction, rich countries have more resources to spend on improvements in ESG factors.

DISPLAY 1: Wealth has explained nearly 60%

of the variation of MSCI’s ESG scores

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Source: IMF, MSCI, MSIM. Data as of July 2019.

A better way: The MSIM approach

The MSIM approach rewards countries for positive ESG progress by incorporating timely expert judgment, and corrects for the systematic bias against developing countries by controlling for a country’s level of wealth. The result is a framework for quantifying ESG performance that we believe is more aligned with investors’ sustainability goals, but also provides for genuine diversification[2] and opportunities.

MSIM sovereign ESG scores start with the underlying environmental, social and governance scores provided by third parties. Since we prioritise change at the margin for ESG factors, we adjust those scores by a momentum factor.

This factor consists of two parts. The first part is provided by a third party and is based on momentum in the existing data. The second part is based on an MSIM sovereign analyst’s analysis of the ESG developments in a country over the past 12-18 months. This is important because we believe that change at the margin is often what moves asset prices, and the underlying data used by third parties often comes with a significant lag.[3] The momentum scores provided by the analyst can help incorporate key changes in a timelier manner, and allow for flexibility to include expert views that may not be fully reflected in the scoring methodology.

Finally, because sovereign ESG scores have been so highly correlated with a country’s level of wealth, we normalise by GDP per capita using linear regression. The result is a score that allows us to quantitatively benchmark countries against their income predicted ESG performance.

This approach has three key advantages in our opinion.

- The first is broad comparability. Portfolios may contain bonds from a wide array of sovereign issuers, and this framework affords the investment teams a consistent basis for benchmarking emerging and developed markets.

- Second, we believe there is a compelling sustainability and practical argument for using a framework that rewards improvements in ESG factors, even if coming from a low base—as is the case with most developing nations.

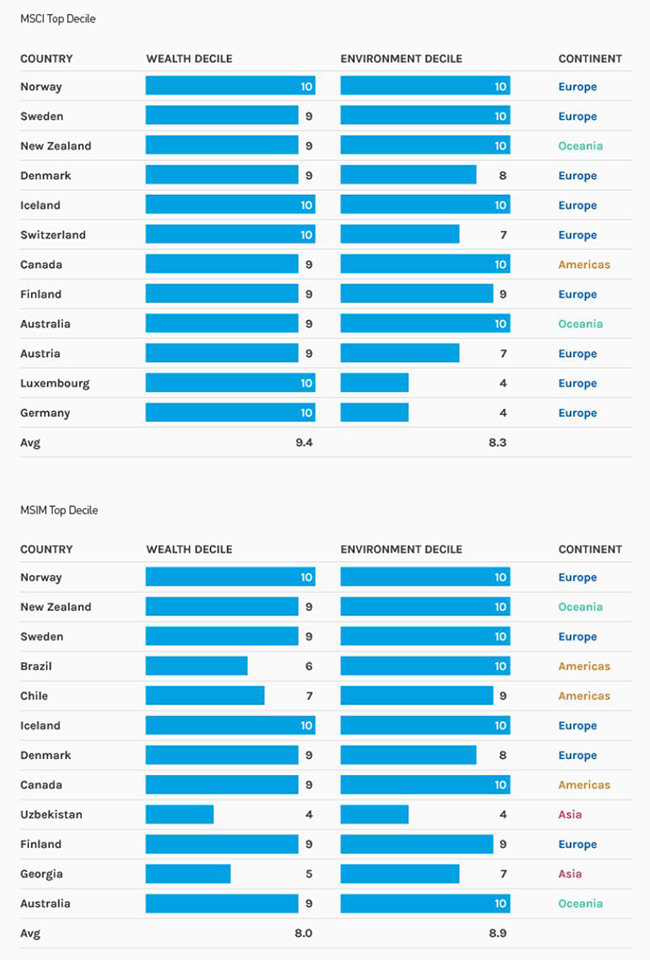

- Third, the MSIM approach results in a much more interesting and diverse opportunity set. As illustrated in Display 2, the top decile using the MSIM framework is a geographically diverse group of emerging and developed markets, an important contrast to the geographically concentrated group of wealthy countries using the unadjusted ESG scores. This presents genuine opportunities for yield and diversification in portfolios in a manner consistent with ESG and sustainability goals.

DISPLAY 2: Comparison of Top Decile

ESG ratings are not intended as a recommendation and are subject to change. Ratings are relative and subjective and are not absolute standards of quality. Ratings do not remove the risk of loss.

Conclusions

MSIM’s sovereign ESG benchmarking framework is a helpful tool in a broader ESG toolkit. It allows investment teams to quantify and compare sovereign ESG performance on a portfolio level. It informs, but does not dictate, the decision-making process. By controlling for wealth and incorporating a momentum factor, it rewards ESG improvements by countries with greater scope for such improvements.

We continue to develop and enhance our sovereign ESG toolkit. While the advantage of this benchmarking framework is its broad scope, our emerging and developed market investment teams continue to explore new alternative data sources that can help us achieve our goal of capturing greater real-time changes in ESG momentum that will better inform portfolio decision making and asset price modelling.

[1] We use the natural log of a country’s GDP per capita at purchasing power parity (PPP) levels, as provided by the International Monetary Fund (IMF). The logarithmic transformation approximates percentage changes in wealth, and better accounts for the intuitive idea that a change from $5,000 to $10,000 per capita GDP is much more significant than a change from $35,000 to $40,000. We use PPP values because it helps account for differences in the cost of living in different countries. Our dataset includes 188 countries where we have both ESG ratings and wealth data.

[2] Diversification does not eliminate the risk of loss.

[3] The underlying data sources for these scores come largely from NGOs and international organizations such as the World Bank. As an example, a key data source is the World Bank’s World Governance Indicators, where scores for a given year are generally published in fall of the following year.

For more on the ESG and sovereign fixed income investing, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.