The world economy continues to decelerate, primarily due to ongoing trade tensions. However, Morgan Stanley Research anticipates that a coming trade deal between the US and China, as well as continued easy monetary conditions, could drive a modest rebound in economic activity in the second half of 2020.

Global economy remains slow but could rebound

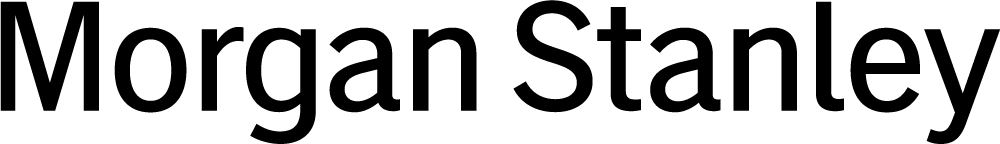

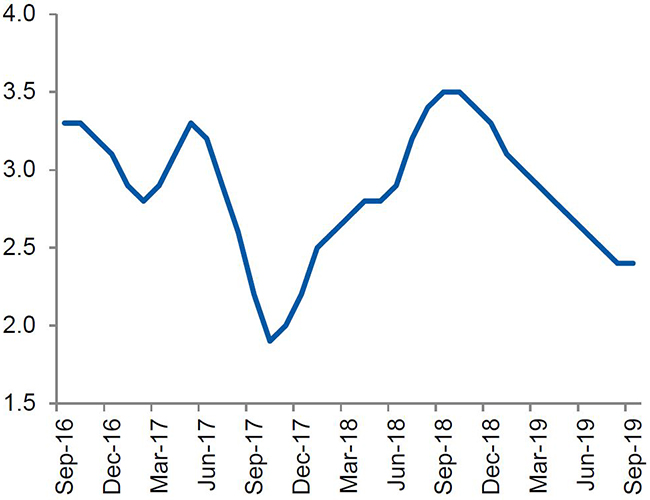

The world economy continues to decelerate, primarily due to ongoing trade tensions. Global GDP has decelerated from 4.1% year on year (yoy) – around when initial tariffs were imposed by the US and China in early 2018 – to around 2.9% yoy in the September quarter. This slowdown may have been more pronounced if it wasn’t for household spending, which has remained relatively stable due to generally solid employment conditions globally (Exhibit 1).

Exhibit 1 – Unemployment Rate (%)

Source: Bloomberg, Morgan Stanley Wealth Management Research.

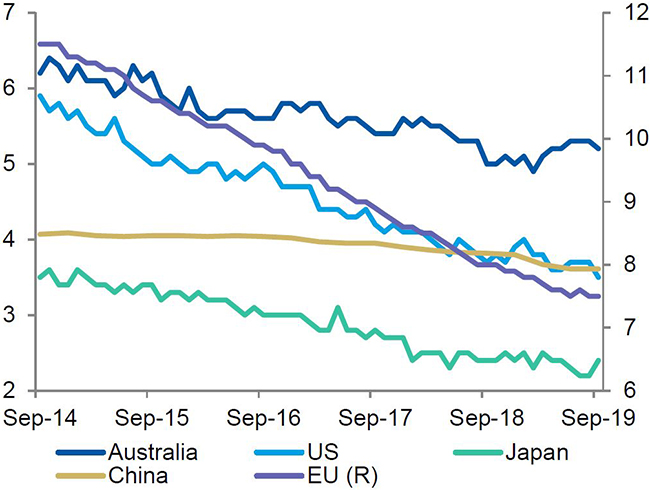

Global manufacturing continues to contract – as shown by October’s Global Manufacturing PMI (purchasing managers’ index) falling further below 50, which is the threshold where a company sees trading conditions as either growing or contracting (Exhibit 2).

Despite the weakening economic figures, Morgan Stanley sees a modest rebound in global economic activity led by the emerging markets in 2020. However, this outlook is highly conditional on trade tensions easing and the central banks continuing easy monetary conditions.

Exhibit 2 – Global Manufacturing PMI

Source: Markit, Haver Analytics, Morgan Stanley Research.

Australian outlook: ‘emergency’ economic conditions a long way away

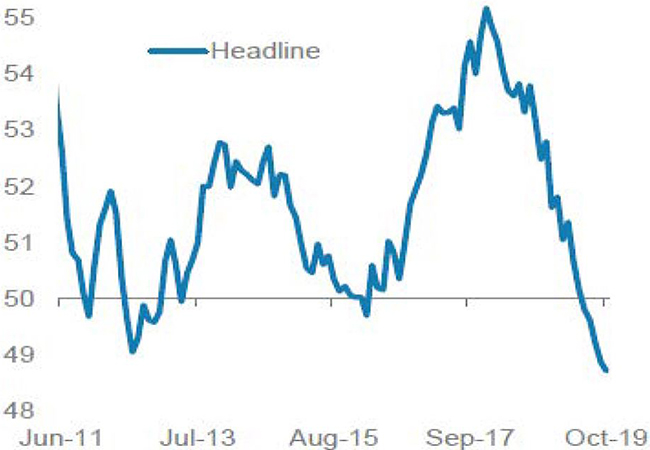

Like the global economy, manufacturing weakness is apparent in Australia with manufacturing PMI reading below 50 (Exhibit 3).

Exhibit 3 – Australian Manufacturing PMI

Source: Bloomberg, Morgan Stanley Wealth Management Research.

Consumer spending, while looking reasonable (Exhibit 4), has disappointed, as it appears the government’s Stage 1 tax cuts have mostly been saved rather than being spent. In the absence of a more robust response from households, the Reserve Bank of Australia (RBA) has been cutting interest rates, with three cuts in 2019. Morgan Stanley expects one more cut from the RBA in February 2020, taking the cash rate to 0.5%. However, further cuts beyond 0.5% or using unconventional monetary policy is unlikely – as these measures are usually reserved only to prevent a looming economic emergency. Given the current economic conditions, an ‘emergency’ seems a long way away.

Exhibit 4 – Australian Retail Sales (YoY % change)

Source: Bloomberg, Morgan Stanley Wealth Management Research.

However, with the economy slowing and little expected help from the RBA in the short term, Morgan Stanley Research believes the Australian federal government will be encouraged to bring forward its Stage 2 tax cuts into 2020. We expect the country's budget position to be strong enough to afford an early introduction and see the $22 billion returned to households. This could drive a strong economic bounce in the second half of 2020, taking GDP growth in 2019 of 1.8% yoy to 2.4% yoy in 2020 – and pushing even higher into 2021.

Australian share market to go through ‘uncomfortable pause’

Morgan Stanley’s view on the Australian share market is more nuanced. Corporate profits have proven to be a reliable driver of share market returns. Until a definite rebound in economic activity manifests late in 2020, corporate profits may continue to soften. Morgan Stanley has dubbed this the upcoming ‘uncomfortable pause’.

Focusing on the largest members of the market, this ‘pause’ is expected to be uneven in terms of its impact on corporate profits, as Morgan Stanley Research sees clear divergence due to industry-specific challenges facing some sectors, independent of the broader economy.

Major Australian banks face three challenges in 2020

Australia’s mortgage volume is expected to grow at around 4% next year. Higher credit standards continue to be a contributing restraint on credit growth. Residential mortgages make up an outsized portion of the assets at the major banks, so weak volumes are a headwind for revenue growth.

The low interest rate environment, ongoing fierce competition, and lower rates of return conspire to reduce profit margins and ultimately challenge profits. We cannot entirely dismiss the risk of further cuts, as payout ratios amongst the major banks remain high. Balancing the payout ratio between the reinvestment needs of the business and the desire for cash by shareholders is increasingly challenging. This is because the major banks face increasing pressure to reinvest profits to address growing regulatory, operational and competitive needs of their respective businesses.

Morgan Stanley Research believes the major banks are unlikely to significantly reduce their costs as increasing competition and regulatory requirements call for investments into systems and people. While these investments can be expected to benefit the business in the long term, the immediate reality is that costs are not stepping down, which is another headwind for sector profits.

Summary

On the economic front, the rebound Morgan Stanley sees in Australia depends on the federal government bringing forward fiscal stimulus via an early introduction of its Stage 2 tax cuts.

With the share market, until we see a rebound in economic activity and corporate profits, stocks are likely to be largely driven by industry-specific factors. In particular, the major Australian banks are likely to remain challenged.

For more on the 2020 outlook, or a copy of our full report, speak to your Morgan Stanley financial adviser or representative. Plus, more Ideas from Morgan Stanley's thought leaders.