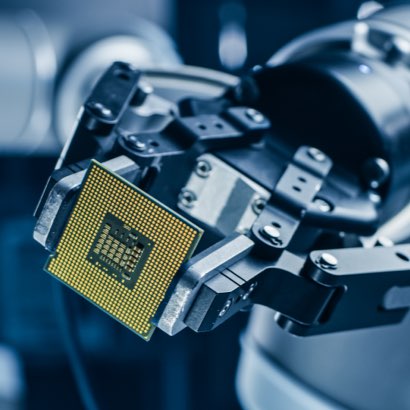

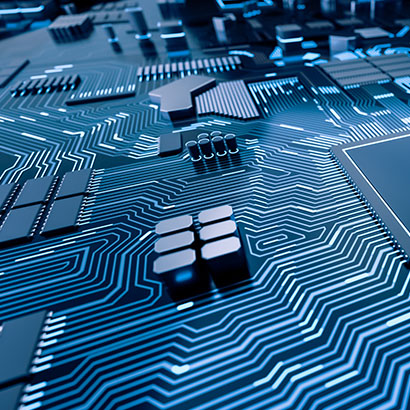

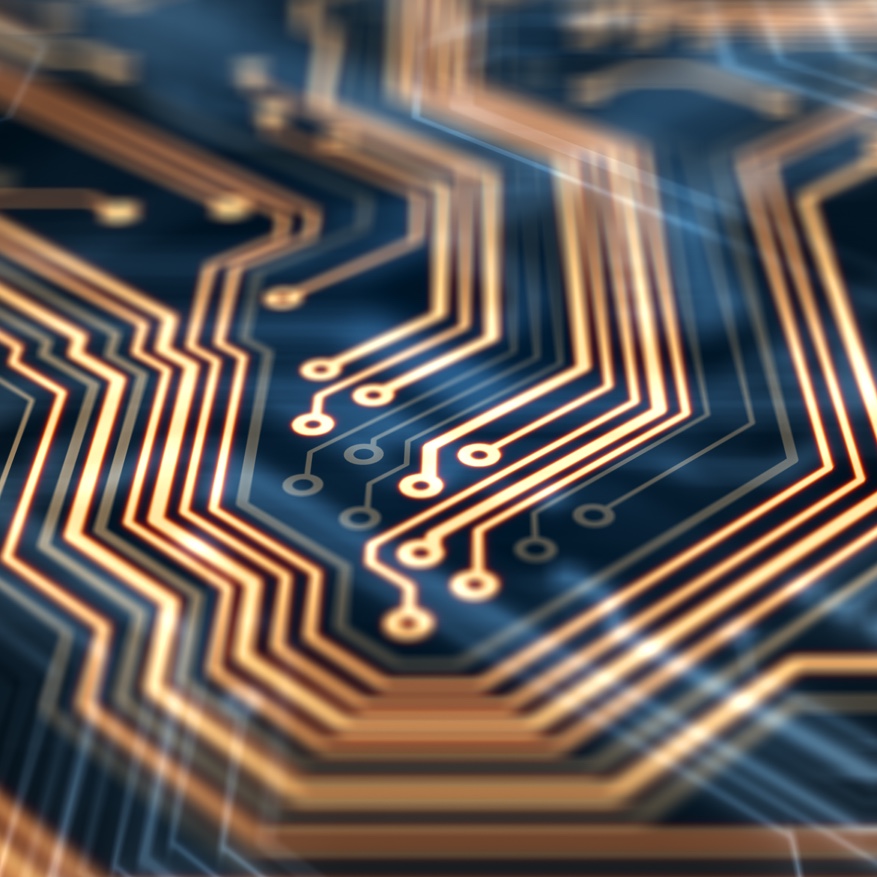

Semiconductors: The Rise of a Global Super Sector

The semiconductor industry is undergoing one of the most significant transformations in its history. Once viewed as a cyclical and often volatile corner of the technology world, semiconductors are now emerging as a structural growth engine powering the next era of global innovation.